C-PACE (Commercial Property Assessed Clean Energy) is a public-private partnership enabled by state law and financed with private capital that finances sustainability improvements to CRE such as: energy efficiency, water conservation, seismic resiliency and wildfire hardening. C-PACE financing can also be used to fund portions of “green” new construction in some jurisdictions.

C-PACE finances these measures with long-term, fixed-rate financing, generally on a non-recourse basis. The structure exists because the state and local municipalities view these improvements as a public benefit, akin to how a sewer improvement would benefit the public.

20-30 years fixed-rate loan terms

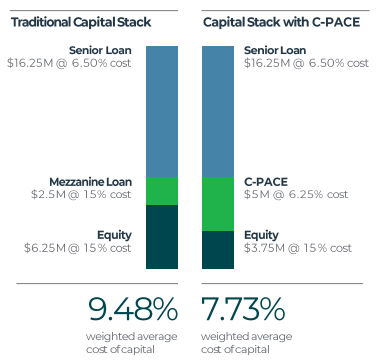

Rates 50% less than mezz/pref

Non-recourse upon completion

Obligation may be transferred on

sale or prepaid

Tailored step-down prepayment fees

100% upfront financing for eligible measure

$500,000 – $500,000,000

All states with active C-PACE programs and continually expanding (Currently): AK, AR, CA, CO, CT, DE, FL, IL, KY, MA, MD, MI, MN, MO, MT, NE, NM, NV, NY, OH, OK, OR, PA, RI, TN, TX, UT, VA, WA, WI, & DC

100% financing for energy, water, and resiliency capital expenditures.

Multifamily, Hospitality, Industrial, Office, Retail, Senior Living, Student Housing, non-profit, and special purpose.

Single-family residential, residential condos, government owned buildings.

Hard, soft, and associated costs connected to mechanical, electrical, plumbing, building envelope improvements and renewable energy sources. Examples include HVAC, LED lighting + facility controls, boilers, windows, and solar.

20-30 years fixed; shorter loan terms available.

Full term; Actual / 360

Capitalized interest reserve during construction

Maximum LTV 30% for new construction/rehab based on the as-stabilized or as-complete property value. Maximum LTV of 35 % for retrofit based on the as-stabilized or as-complete property value.

90% LTC for New Construction & Value-Add Development (C-PACE + Mortgages)

95% LTC for Maximum C-PACE + Mortgages LTC of 95 % for retrofit projects based on the as-stabilized or as- complete property value.

Total debt to cost ratios are subject to appropriate DSCR ratios and senior lender approval

Minimum requirement of 1.25x (1.10x for multi-family) inclusive of energy savings & total debt.

Milestone-based disbursement schedule; generally pro rata with senior lender for new construction/rehab projects.

No lockout period, yield maintenance or exit fee

Tailored prepayment fees that step down over time

Non-recourse upon completion

C-PACE financing requires lender consent from any lienholder on a property. C-PACE financing is non-accelerating even in the case of default.

C-PACE may be paid off at sale/refinancing or transferred with title with no restrictions