C-PACE Financing is in development in North Carolina and will allow building owners and developers to access the capital they need to make energy-related deferred maintenance upgrades in their existing buildings, support new construction costs, and make renewable energy accessible and cost-effective.

20-30 years fixed-rate loan terms

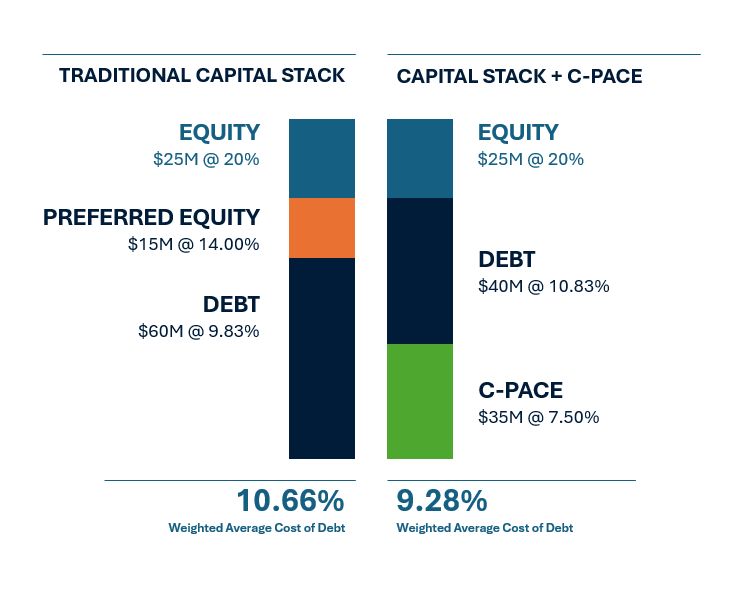

Rates 50% less than Mezz/Pref

Non-recourse upon completion

Obligation may be transferred on

sale or prepaid

Tailored step-down prepayment fees

100% upfront financing for eligible measures

$2,000,000 – $750,000,000

All states with active C-PACE programs and continually expanding (Currently): AK, AR, CA, CO, CT, DE, FL, GA, HI, IL, KY, ME, MA, MD, MI, MN, MO, MT, NC, NE, NJ, NM, NV, NY, OH, OK, OR, PA, RI, TN, TX, UT, VA, WA, WI, & DC.

Build-to-Rent, Multifamily, Hospitality, Industrial, Office, Retail, Senior Living, Single-Family Rental, and Student Housing.

Single-Family Residential (1-4 units), Individual Residential Condos, and Government-owned buildings.

20-30 Years; Up to 40 years in based on the jurisdiction.

Full-Term; Actual / 360.

Capitalized Interest Reserve (PIK) during construction.

Max LTV 35% for New Construction/Major Rehab based on the as-stabilized or as-complete property value.

Max LTV of 35 % for Retrofit based on the as-stabilized or as-complete property value.

– 90% LTC for New Construction & Value-Add Development (C-PACE + Mortgages).

– 95% LTC for Maximum C-PACE + Mortgages LTC of 95 % for retrofit projects based on the as-stabilized or as- complete property value.

– Total debt to cost ratios are subject to appropriate DSCR ratios and senior lender approval.

Minimum requirement of 1.00x inclusive of energy savings & total debt.

Milestone-based disbursement schedule; Generally pro rata with senior lender for new construction/rehab projects.

No lockout period or Yield Maintenance.

Tailored prepayment penalty that step down over time.

Completion Guaranty (during construction); Non-recourse upon TCO.

C-PACE financing requires lender consent from any lienholder on a property. C-PACE financing is non-accelerating even in the case of default.

C-PACE may be paid off at sale/refinancing or transferred with title with no restrictions.